How Optimizing the Customer Experience Can Help Your

Business Survive – and Even Thrive - in a Recession”

Executive Summary

The Recession Changes Everything

The bottom line is that whether in B2B or B2C the current recession changes everything because it forcibly

reorders your customers’ priorities.

For sure, price becomes more important than ever. Yesterday’s “must have” feature or service may be

today’s “nice to have.” Yesterday’s IT automation priority may now be less important to your customers

than access to live service support and advice. Being easier – and therefore more cost effective – to deal

with may now be more relevant to your customers than innovation in product features or functionality.

So what are your customers thinking - and what will they do now? Almost regardless of what industry

you’re in, your customers are going to:

Your business is almost certainly now spending money and effort in the wrong places if it’s continuing to

use a paradigm that has now been overtaken by current events.

The US is now officially in a recession along with most other developed economies. Stock prices have

plunged worldwide, unemployment is rising and the economic outlook for the next couple of years is

bleak. It’s no longer “business as usual” for any company or industry, and past performance is no

guarantee of future results.

How to “future proof” the value chain (in particular the customer facing capabilities) will require a level

of understanding what customers value together with speed and precision in execution that is currently

rare. Those that do will optimize both their top line (revenues, loyalty etc) and bottom line (costs,

efficiencies) and overall business effectiveness.

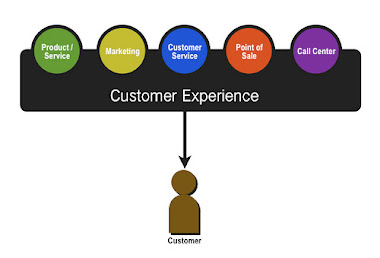

The first part of this paper (“The Recession Changes Everything”) looks at the pressures companies are

now under and how their likely responses will impact the Customer Experience. The second part

(“Measure Twice, Cut Once”) suggests some practical approaches to optimizing Customer facing

capabilities in a recession (eg: map the current experience, validate it with customers, then focus on

what really matters), the primary objective being a lower customer cost-to-serve while

improving/maintaining revenue streams.

• Need reassurance about you. Organisations and individuals face massive uncertainties and will

need to be regularly reassured for some time to come.

• Be less forgiving of service or process problems. Change reduces established loyalties and

operational deficiencies that were once tolerated may now be all the justification a customer

needs to go elsewhere.

• Fundamentally re-evaluate your value proposition. The

strategic challenge is to deal effectively with the constant

pressure to commoditize your value proposition.

• Place even more focus on price. Businesses everywhere are

deferring non-essential purchases as concern with brand equity is

replaced by cost-driven indifference and short-term focus.

• Become less loyal to established suppliers. Established

relationships are vulnerable when your customer’s job #1 is

ensuring his own survival.

• Place more emphasis on peer endorsement for new suppliers.

Customers seeking new business relationships will seek strong

peer endorsement before committing as no-one can afford to

make a mistake.

• Seek business relationships with companies that can help them regain a sense of control.

Some customers will place a higher premium on working with businesses that can help them

address the devastating loss of control which the recession has caused.

In approaching these changes in customer behaviour most companies will seek either to enhance margin

by reducing spending, or help customers regain some sense of control by addressing selected areas of their

concerns. An example of the latter could be a bank sending out comfort letters to customers explaining

how the bank intends to ride out the storm, thus alleviating emotional fears. In either case the mindset

that prevails will dramatically impact the Customer Experience offered.

These two responses need not be mutually exclusive either. Cost cutting in one area can be used to fund

investment in another - more highly leveragable - area. In any business, rational “hygiene factors” are

obviously necessary to satisfy basic customer expectations. Examples of hygiene factors for many

businesses are basic access possibilities, availability and welcome of service staff, getting resolution to

queries within a reasonable time, quality of product, etc. The opportunity for cost-cutting in these areas

varies business by business, but should be approached with caution and with a clear fact-based

understanding of the potential impact on the Customer Experience, these “basics” may well have changed

or been added to (eg: need for reassurance) by recent events .

And of course “hygiene factors” alone are not sufficient to drive retention, loyalty or word of mouth

recommendation – or to create precious reassurance for customers in tough times. That requires emotional

drivers such as trust, confidence, empathy, personalisation and sincere friendliness, promising on

commitments, time to listen, and maybe even over-delivering in these areas in the coming months. Before

either cutting costs that impact “hygiene factors” or focusing precious discretionary expenditure on

upgrading the Customer Experience, the key is to precisely understand how the recession impacts the

relative importance of individual touch points.

Yesterday’s high-leverage touch point may not be seen as such today, and equally what was seen as an

area of waste yesterday may look very different today. The key is to know what has changed and to find

out what now matters to your customers, and not simply to guess.

As an example of a company responding to

the recession by trying build up its

emotional drivers rather than cut back on

hygiene factors, one of the largest US

mutual fund and brokerage organizations

has just launched an aggressive “customer

outreach” initiative designed to help stem

the outflow of money from its funds,

targeted at a wide segment of its customer

base, including those with relatively modest

investment balances. Their efforts focus on

driving active customer engagement and

include invitations to conference calls,

webinars, free financial planning sessions,

in-person seminars, and changes to onand

off-line communications. Clearly this

organization concluded that investing in

tactics that would impact the emotional

drivers of its business was a better

approach than cutting back on the basics.

Change Creates Opportunity

This type of change is painful but it also creates opportunity in at least two dimensions:

a) As a result of the recession some companies will have the chance to

acquire new customers from competitors who struggle, go under or no

longer have the resources to compete effectively.

b) When individuals face major change in their lives (eg: moving home)

ties to all their existing loyalties and relationships are loosened.

A clear understanding of what kind of Customer Experience those

displaced customers are now looking for is therefore critical if they are

to be won over.

Some companies will acquire weaker competitors and will have to

integrate their customer facing capabilities. For the acquirer, having a

clear vision of the desired Customer Experience is critical if the

integration is to be implemented effectively, acquired customers will be

more likely to leave if they experience any service issues.

And for executives trying to drive a change agenda within their

organizations, the current economic downturn does have a silver lining.

In most businesses the status quo now looks less and less attractive to top management. There is likely to

be a consensus that change is needed, and for an executive with a plan of action, there is also personal

opportunity. To quote Rahm Emmanuel, the incoming U.S. White House Chief of Staff, “Never let a crisis

go to waste.”

Whether businesses like it or not, the recession is a catalyst for change, and effective leadership will be the

single most important characteristic of those companies that will survive and even prosper. At Mulberry

Consulting our contention is that the most powerful contribution a senior executive can bring to the table

in mapping a strategic path toward a clear and concrete vision of how to optimize the company’s

Customer facing capabilities in response to the current economic climate.

“Measure Twice, Cut Once”

The old carpenters’ maxim for getting a job done right, “measure twice, cut once,” applies well to

businesses now looking to reduce costs in a recession. Before cutting – whether it’s people, budgets,

services or product features – businesses need to first measure carefully what the net impact on Customer

Experience will be. This is not an area for guesswork as mistakes are likely to quickly invoke the law of

unintended consequences. Nor is it an area in which to deploy unproven techniques for measurement or

analysis. It requires a quantified evaluation of the end-to-end Customer Experience using proven tools and

techniques, preferably against a benchmark of peer group performance.

McKinsey recently interviewed senior executives from eleven leading service delivery companies, and all but

one agreed that improving the Customer Experience is growing in importance to their companies,

customers, and competitors. However, many of them will discover that their long-held but seldom-

The first step is an objective evidence -based assessment of the customer’s view of what has changed –

what is important now and what’s not, what can be cut and what can’t, and how to go about it.

In another example, a multi-national

insurance company with a major business

in Mexico found that by significantly

upgrading the face-to-face experience

provided in its large customer service

centres, it improved retention rates,

created substantial goodwill, and “raised

the bar” significantly for competitors. (In

Mexico middle and lower income

customers prefer to conduct their insurance

transactions in person and are prepared to

travel long distances and endure lengthy

waits to do so, primarily out of distrust of

the local postal services.) The key here

was that the insurance company had

measured and understood the emotional

power of treating its less affluent customers

with decency and respect, and chose to

invest in this key area of the Customer

Experience rather than cut back on

“hygiene factors” when the local economy

started to deteriorate.

validated assertions about what customers really want are either wrong, or have now been substantially

altered by the recession.

Against this backdrop we offer some specific examples as thought-starters to help companies manage

their customer facing capabilities to optimise their Customer Experience while maintaining or reducing

costs:

• Optimize the end-to-end customer experience. From a business perspective, why spend

resources to satisfy customers at every stage of an entire customer journey if only a fraction of it

will be remembered? In addition, why spend resources satisfying all customer segments if many

don’t care? We know that human beings only remember certain peak and particularly end

moments of an experience, so the challenge is to find out how to reduce spending on touchpoints

less critical to the customer, and of course which customer segments to apply this to.

• Consider the possibility that the mantra of all-embracing customer-centricity might be

wrong. For example, at a Northern European mobile telco the generally held view was that to

increase the “very satisfied” proportion of customers the company needed to improve the entire

end-to-end service experience, from “becoming a customer”, “receiving a welcome call”, “getting

started”, “receiving the first invoice”, “using service channels”, “discovering new usage features”,

“receiving a service call”, “contract renewal”, “offer to downgrade” right through to “being saved”.

Analysis quickly revealed that most important to the brand and to its target customers was

improving the initial experience of “becoming a customer” and “receiving the first invoice”.

Furthermore, the proportion of new customer dissatisfaction by far outweighed the rest of the

customer base, so focus was placed on customers with less than six month tenure. The remedy lay

in simple, low cost initiatives such as better information at stores and online explaining that the

customer’s existing mobile supplier may delay the number portability process, plus clear graphics

on invoices explaining how to understand the bill. Thus the telco did not try to satisfy all customer

needs, but became better at generating positive memories, and ultimately reached its satisfaction

and retention goal.

• Find the optimal service level. Mulberry Consulting is often asked what the service levels at a

given company should be. Clients ask what others are doing, and what customers are expecting.

The bad news is that there is no generic answer to the question; the good news for some

companies is that they may be maintaining unnecessarily high – and expensive - service levels. For

example, if customers of Microsoft have a high expectation that their problem will be solved when

they call the company, the chances are that they will wait several minutes, and perhaps as much as

ten minutes, without jeopardising brand equity. On the other hand, if customers are unsure

whether their problem will be resolved at all, then frustration will set in rapidly and sub-one minute

service levels start becoming important - and extremely expensive. So the trick is to monitor

abandon rates and customer satisfaction in real time to find the inflection point where service level

reaches an acceptable level.

• Improving First Call Resolution (FCR) has a dramatic impact on costs, and improves the

overall Customer Experience. Improving FCR is a classic efficiency project, potentially delivering

large cost savings and an improved Customer Experience. It is also characterised by low risk, low

investment and high returns, to the degree that one call centre we worked with actually boosted

sales by 77%, a massive impact

Our models show FCR as the independent variable which often has single highest effect on

customer loyalty. This is understandable given that customers who get their query answered

straight away do not need to call back. This in turn reduces the number of calls, and consequently

reduces frontline workload requirement and costs. However, even though improving FCR may be a

low risk/ low investment project it is by no means easy. There are three basic causes for poor levels

of FCR. First, frontline agent-related areas are the primary source of error (44-57% of root cause)

but also the quickest to fix. The majority of problems are due to agent error, for example providing

unclear or wrong information. Second, organisational and process factors (32-37% of root cause)

are the second most important source of problems but can require system changes entailing

longer resolution. This could for example impact processes for claims management. Third,

customer behaviour itself may be uncontrollable (11-17% of root cause) and difficult to fix, but

fortunately this constitutes the least common reason for low FCR.

In one business a simple remedy to address frontline agent problems was deployment of a

suggested script for the agents containing one must-say sentence in each of the call’s five phases.

By following this simple structure, such as wrapping up the “Farewell phase” with “…OK, I can

confirm I have now ordered [product] for you, at [price], which will arrive at [date/time], thanks for

your order. Is there anything else I can now help you with?” many more calls were resolved first

time, providing huge cost savings, with minimum investment and enhanced Customer Experience.

• Make it your first priority to measure and re-evaluate your end-to-end experience process.

Talk to your customers, potentially focusing on one segment at a time, and make sure you

understand what they really value in the areas that you serve them, as distinct from what they see

as nice-to-have but not essential to your core proposition. There may be cost savings in surprising

places.

• Finally, remember that a little kindness goes a long way in hard times. People from top to

bottom in service businesses should never forget that now more than ever customers are human

beings too, and that they may be more influenced by genuine kindness and consideration than by

an IT upgrade.

No comments:

Post a Comment