Key Customer Experience and Social Trend related to generation Cohorts

More than seven decades have elapsed since the British Government printed its 'Keep Calm and Carry On' poster to calm the nervous population at the outbreak of the Second World War. In the current economic crisis, the words have struck a chord, with homes and offices across the UK sporting coffee cups emblazoned with the slogan.

The words may provide comfort in a discomfiting present but distract from the need to look beyond today at what the future holds and to start planning for it now. As the economic storm battering confidence across the globe looks set to continue into 2012, business leaders who focused primarily in the last year on short-term exigencies can no longer afford to be disengaged from longer-term strategic issues.

While there are unknown elements in the future, many of which will be challenging, there are also exciting opportunities from factors such as: 'the Cloud'; new enabling technologies; new working patterns; and new contact channels.

Our task is to work out how best to harness these opportunities for the simultaneous benefit of customers and our organisations. In order to do this effectively we need to understand our customers' preferences and to up-skill our employees to become 'knowledge workers' who can meet the needs of customers who want increasingly complex issues resolved fast.

In 2012 our work at CCA will capitalise on the wealth of knowledge possessed by our member organisations and expert advisers and on the ground-breaking work already under way through Customer Experience Council, Research Council and Supplier Council.

The key trends we see emerging through 2012 are:

OUTSOURCING PARTNERSHIPS WILL ATTRACT MORE INTEREST

The sourcing debate has become more prominent, evidenced by a

rising number of enquiries from members focused on developing good

sourcing partnerships. Offshoring remains on the agenda, but in a new

light – rather than simply being a case of traffic moving east, we have

offshoring operators investing in western businesses. With the pound

depressed, and relative costs lower, there are obvious inward investment

opportunities in the UK.

HANDLING VOICE CALLS WILL REMAIN A CHALLENGE

From recent consumer research we conducted earlier this year

showed more than 70% of consumers still want to use the phone now and in

the future (47% in 5 years time). The recipe for a successful blend of

self-service and voice will vary, depending on an organisation's

propensity to embrace automation and personalisation and how this fits

with their brand.

SOCIAL MEDIA – FRIEND OR FOE?

The reality borne out by our research on social media is that

most large organisations are still finding their way in terms of: which

department manages the activity (see our How to Build an All-Star Social Media Team);

whether it has the potential to become an interactive channel for

customer contact; and of course how to construct an ROI around resource

planning. Increased transparency demanded from consumers will result in

social media becoming a more significant voice of the customer.

SUPPLIER RELATIONSHIPS REQUIRE NEW GUIDELINES

This inevitably calls for better relationships between contact

centre operations, IT, procurement and of course the suppliers of

products and services. CCA Supplier Council takes a lead role in

formulating guidelines for establishing more productive relationships

which will deliver positive results for all parties.

NO UNIFORM SOLUTION FOR MULTI-CHANNEL STRATEGY

The skills needed to successfully run a multi-channel,

multi-site, multi-partner operation is becoming more challenging. As

customers increasingly use intuitive technologies such as smart phones,

tablets etc businesses will need to reflect this trend in their customer

interfaces. Mixed-model operations are hugely important and are

becoming increasing recognised by boards globally, particularly where

mergers and acquisitions are becoming the norm.

CUSTOMER DATA NEEDS TO INFORM DECISION MAKING

Harvard Business Review reported that companies have collected

more information from customers since 2007 than was ever collected prior

to that date. This should come as no surprise to many of us in this

sector who are well aware of the multitude of ways of collecting

customer opinion and information. The objective is to ascertain what

information they need to foster better decision-making and to avoid the

real rise of rear-view mirror management – a key focus for CCA Customer

Experience Council.Using Cohort Analysis to Optimize Customer Experience

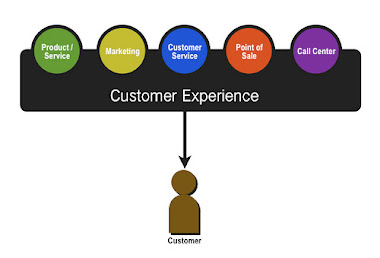

A bad experience with any of the activities in the value stream can result in a dissatisfied customer and a loss of revenue. The goal, then, is to create a journey that provides maximum value to customers while also being highly efficient and profitable for your business.

As you strive to improve the customer journey, how can you determine the effectiveness of your efforts? One method is through cohort analysis.

What is Cohort Analysis?

Cohort analysis compares the behavior of two or more groups of people. Each group shares an internal characteristic and is referred to as a “cohort.”Our last article looked at the experience patients have in a doctor’s office. Taking that journey as an example here, we can create cohorts based on the week in which patients visited the doctor. Week one maps to cohort one, week two to cohort two, and so on. In this case, the week the patient visited the doctor would be the cohort’s internal characteristic.

Grouping people into cohorts enables you to look at multiple areas of a business, such as the methods for acquiring, retaining, and generating revenue. It can also give you insights into which customers you should focus on, which channels of communication work best, and which areas need an investment of resources to improve the experience.

Our doctor's office journey has eight touch points, and we want to see if all of them are improving:

- Patient check-in at the front desk

- Waits to be called for further information

- Called to the front desk to validate personal and insurance information

- Waits to be called again to see the doctor

- Called to go to a room to see the doctor

- Waits for the doctor

- Speaks with the doctor

- Returns to front desk to make a follow up appointment or pay for services

How to Conduct Cohort Analysis

Conduct Cohort Analysis

Start by defining your business question. To insure your research will deliver insights, it's important to spend time defining your business question. It should be based on the objectives of the business and the problems the research will attempt to solve.

In our example we want to know: “Do our improvements reduce the wait time for our patients?” We want to measure the effectiveness of the changes we’ve made and see if customer experience is improving. You may have to iterate and refine the question to ensure it aligns with business objectives.

Define a metric (or set of metrics) that offers insights into your business question. In the above example, time is the key metric that we use to answer our business question. We want to understand how much time a patient spends waiting at each touch point in the journey.

Define your cohorts. Our cohorts are based on the week during which the patients visit the doctor. In other situations you may define your cohorts differently. For example, if you were looking at an e-commerce site you might define your cohorts as customers who purchased within 24 hours of creating an account and customers who did not.

Perform the analysis. In a typical week the doctor sees 100 patients. Each cohort column shows the average amount of time the 100 patients spent at each touch point.

In our data set, prior to making any changes, the total waiting time was 131 minutes which we can take as our baseline to compare other weeks against. By comparing our different cohorts against this baseline, we see a decrease in overall non-value added time by about fifteen minutes a week. It also becomes apparent that the wait time in touch point number six does not decrease. This insight can lead us to perform further investigation into the drivers preventing the decrease.

To gain further insight you might also look at your data through internal and external lenses to understand what could be influencing the changes. For example:

- Your business. Take a look at anything internal that can impact the data. Are staffing levels appropriate? Any there issues with technology breaking down? Is the doctor overbooked?

- The outside world. Take a look at any external forces that could influence business. Do holidays impact the business? Does the economy have influence? Are there any recent events in the media that should be considered?

No comments:

Post a Comment